When I was 21-22, my conflict was, “What do I do as a career?”

When I was 23-24, my conflict was, “What place do purpose and passion have in my day job?”

When I was 25, my conflict was, “Should I pursue professional writing as a full-time job?”

It wasn’t until I was 26 that I realized all these life questions were centered around the necessity of work instead of personal fulfillment. “But of course I have to work! I have bills to pay. Work is not optional for me.”

But what if—one day—it was?

For young people transitioning into the full-time workforce, one of the most daunting feelings is the 40 to 60-hour work week dominating “the rest of our lives,” or at least our good years. We worry we’ll be too old in retirement to enjoy life the way we can now—with our vitality, our ambition, our wanderlust, and our healthy bodies.

Now that I’m 27, I’m asking a more holistic question that prioritizes my true desires: “How do I create a life where I spend more time doing things I love and less time doing things I don’t love?”

Answer: Save enough money to never work for a paycheck again and start incorporating the things I love into my daily life right now.

This is my path to financial independence, or in other words, a work-optional life where I do not need a job for money’s sake (passion-driven work is another story).

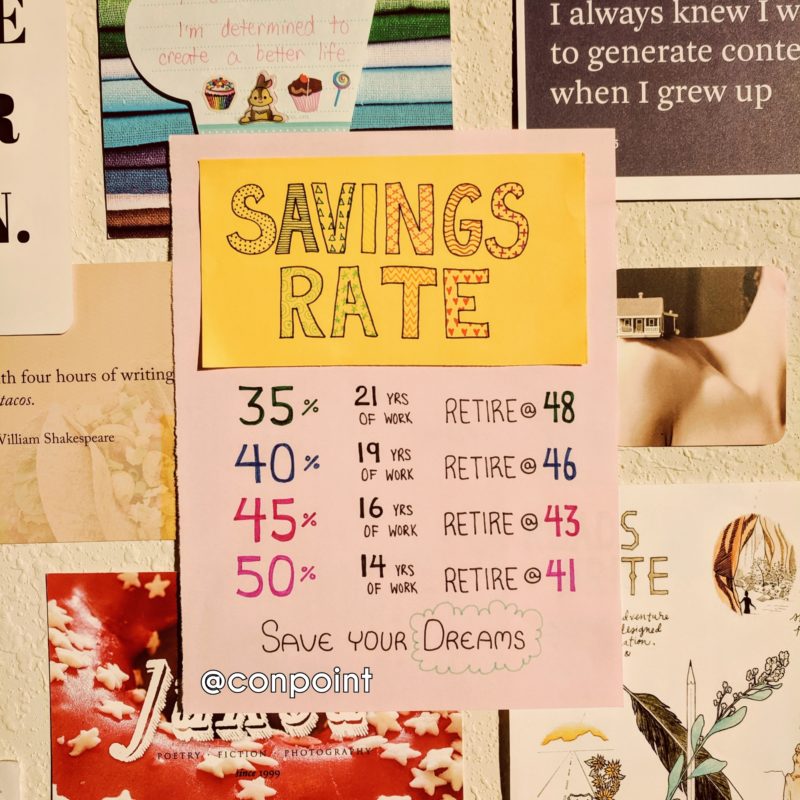

The best predictor of when I will reach financial independence is my current savings rate.

Savings Rate = money not spent / my post-tax paychecks

To calculate this and understand if this lifestyle feels sustainable, I first need to know where my money goes and how much of it.

Since January 1st, 2019, I’ve manually tracked every one of my expenses in a spreadsheet. If I spent money, it’s a line item: rent, car insurance, dinner dates, ride shares, a new dress, cash tips, donations, a cup of coffee. Every single thing.

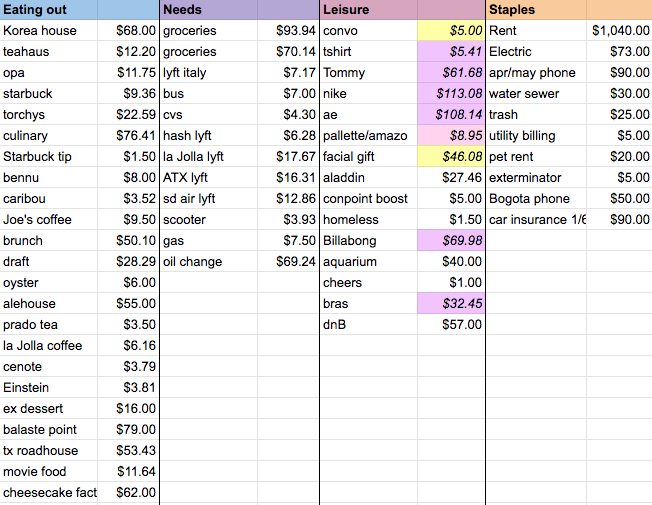

Here’s an overview of my June 2019 spending (this is just a portion of my monthly savings tracker):

My June savings rate was 48%.

In other words, Present Connie lived on 52% of her earnings and paid Future Connie 48%+ of her earnings (if you account for compound interest). How generous of me. 😊

The chart below is a projection of my retirement dates based on four different savings rates. I used a calculator that considered my current net worth + static income, and assumed a 5% return on investment and 4% withdrawal rate. The withdrawal rate is based on the Trinity Study, which shows 4% as the magic annual amount you can spend while making your wealth last “forever”/until you die. (A big statement, I know, details and arguments for/against it are all linked at the bottom on Mr. Money Mustache’s site)

I understand this is a very rough ballpark estimate—one that doesn’t account for pay increases, children, and unforeseen events like freak accidents (see: children) or winning the lottery. However, it is a spectacular way to quantify the factors that are predictable. More importantly, it is putting a price tag on the lifestyle I lead now and showing me exactly how my behavior shapes my future. Wild.

I’m not waiting until I’m 67 to retire. And if I continue to live and save as I do, I won’t have to.

I’ve made an active decision that I’d rather make small sacrifices now to take back potentially 20-30 years of my life, one where a week is measured in 168 hours and I’m free to plan my daily schedule around nothing more than sunrise and sunset.

This isn’t to say I despise my job or feel the paid workforce is something I desperately need to escape. Rather, it’s recognizing how happiness is entirely achievable on my own terms. My life does not have to align to societal norms of grinding until your golden years. There are things within my control right now that can increase the amount of freedom, flexibility, and stability I have in my 40s and beyond. That is powerful.

Beyond financial independence, this has been a way to self-soothe when I’m dealing with mental health issues like depression and anxiety. During the lows, it’s hard to believe my own mind. What I love about following a financial journey is data and numbers do not lie. They are objective and therefore more reliable than my scrambled and emotional mind at times.

- I may feel overwhelmed by work, but I can ground myself in the fact that I only have to do this for 15 more years if I stay disciplined—a whopping 25% of my total working years are already behind me.

- I may dread a Monday, but I can aim for 40% savings rate this month, which if sustained would eliminate 1,000+ Sunday Scaries from my future.

Talking about financial planning can be dry and boring, I get it. But when I think about the rewards of a future life I could have, my self-made freedom, it hits like whiskey. It’s the most romantic thing I’ve ever done. The safest drug and the highest high.

I’m a madwoman sunbathing in my laptop light, toggling account tabs, and reformatting formulas. I’m at the beginning of learning to make this work for me, yet I’m already in more control than I’ve ever been.

📙 Resources:

That kind of looks like a lot of eating out for someone who is trying to retire before 50.

You’re right that I eat out a lot, this was an especially heavy month, too. So fear not, I’m not always this bad haha. Eating out is my choice “fun” expense and something I don’t want to give up because I enjoy it so much. Even so, I was still able to save over half of my earnings last year and stay on track to retire before 50, my 2019 recap here. I think it’s a great example of how you don’t have to sacrifice what you love if you budget for it. You can enjoy life and still reach your financial goals. Thanks always for reading!

Fantastic post. Found it through your recent comment on Austin Digital Jobs. Will be reading more!

Thank you for reading and sharing where you found me! I tend to post more on my Facebook and Instagram (Connie Conpoint / @conpoint), but trying to write more long-form here this year. 🙂

Hi Connie, found your instagram and blog through Francistogram! Just wanted to say, your discipline and the way you’ve structured your financial life is really amazing! It’s inspired me to take a stab at it too — do you have a google sheets template your users can use as a launchpad into this life?

Best,

Lorri

Hi Lorri, thanks for your msg and sorry for the delayed reply. I don’t currently have spreadsheet I’m sharing publicly. Would highly recommend checking out @mywealthdiary on Etsy & Instagram for her wealth dashboard. It’s the top one I recommend based on her content, quality, user reviews, & affordability.