1. Look for reasons to like someone instead of reasons not to. Whichever you choose, you will find it. Life is better surrounded by people you like. And liking someone is within your control.

2. Your relationship is you and your partner’s to respect. It is no one else’s responsibility. When it appears someone on the outside has threatened the relationship, know that threat is coming from the inside. Healthy relationships are communicative ones where partners are honest about their insecurities and concerns. When issues arise, they can only be resolved by the two people in the relationship.

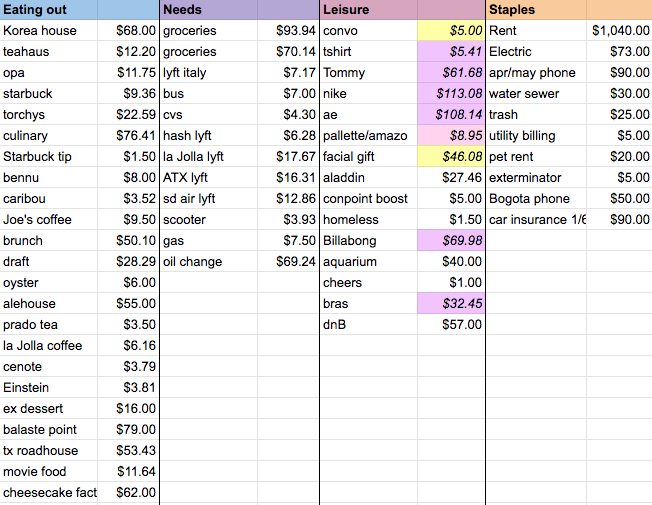

3. Lean into your frugality. You may feel like a cheap-ass right now, but future you will thank you. (Thank you for thinking of me!)

4. Your criticism of others are usually the things you mind about yourself. When you have that knee-jerk reaction to judge, think about why you feel so strongly about it. Is it possible you resent that negative trait in yourself?

5. It is more important to be diplomatic and well-received than being “right” at work. You decide who you want to be, but your reputation is created by how others perceive and talk about you. If you are wrong and humble, coworkers will take time to explain why you may be mistaken and help you. If you are right and arrogant, nobody will want to work with you and nobody will want to see you win.

6. Stop shopping to cheer yourself up. Spending is not a healthy response to sadness. Instead of mindlessly perusing TJ Maxx, think about what feelings are driving you to indulge. How else can you cope with these feelings? What constructive hobbies can improve your mood?

7. Open a high-yield savings account.

8. Coworkers are not a separate pool of people in the world. They are sourced from the same group of strangers on Earth that you could meet in a social setting. Understand the people you work with — it’s just as important as understanding your friends.

9. If you seek to be understood, be willing to explain. Example: I hate seeing people waste food. This is because I grew up behind the counter of my parents’ restaurant, witnessing the excessiveness of all-you-can-eat buffets. I spent thirteen years clearing half-eaten plates into the trash, internalizing it as portions of my family’s livelihood in the dumpster. I associate wastefulness with privilege and a lack of respect for another being’s resources. I associate it with self-centeredness paired with a lack of self-awareness for what one’s body needs. Wasting food may not be a big deal to others, but it matters to me for these reasons and that’s why I react the way I do.

10. You have a greater capacity to help others after you help yourself first.

11. Learn more about what your money is doing. The feeling of understanding and controlling your finances is like no other. Don’t be discouraged by the mountain of things you don’t know. Start small. Write down specific questions. Answer those. Write down more questions. Repeat.

12. When you are at work, pretend to be someone who thinks, tries, and cares. After business hours, you are free to be and feel and say whatever you want. I know you struggle coming to terms with your “work identity” feeling like an inauthentic version of your actual self, but it doesn’t have to be so polarizing. During work: think, try, and care. Keep doing this and slowly your dual personalities will feel less binary. And maybe one day, you’ll naturally think, try, and care at work.

13. Show up exactly as you are. You will find that you are happier the sooner you arrive as yourself. At work. When meeting new people. In your own skin. Just be you.

14. It’s okay to feel meh about some people. You’re going to live on the outskirts of some friend circles and that’s okay. It means these relationships are not meant for you long-term. When you meet people you naturally want to spend more time with, you will know. It will feel hard not to talk to them. These relationships are meant for you.

15. Workplace rule of thumb: When you get shafted, the resume gets drafted. It should be ready to go before you are.

16. When someone hits on you, it is not a testament of your attractiveness. It is an expression of their need for attention, companionship, or validation. We aren’t flattered when beggars ask us for money. That’s because we understand we don’t “appear rich.” Rather, the person in need is simply reaching out and we happened to be present. If more people acknowledged this, there would be more humility and less guilt about denying people our time, energy, and other valuable resources.

San Diego 2019

17. Don’t take your love life frustrations out on someone else’s relationship. You may not believe in monogamy right now, but the spite you feel toward the “broken” concept does not justify hurting one of its bystanders. If you actualize someone else’s worst fear (betrayal), it will have a lasting impact on their ability to trust and love. You may not have had a personal responsibility in the fidelity of their relationship, but you violated the social contract of doing no harm to strangers. That’s on you.

18. Committing to a monogamous relationship will not stifle your creative freedom for writing. So chill out and stop worrying about it. Plus, you will have new content from a girlfriend’s perspective.

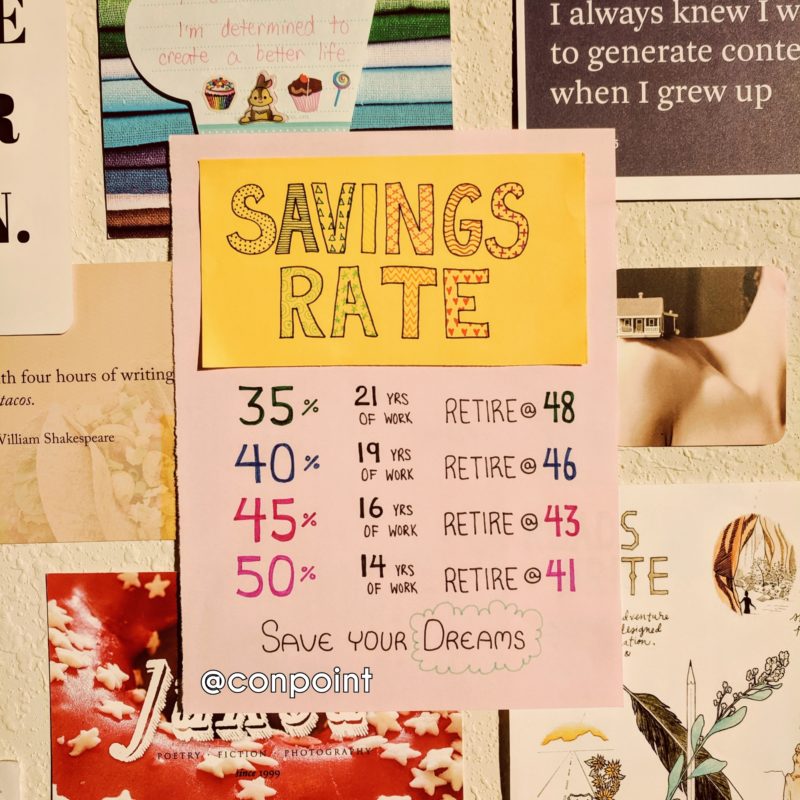

19. Your retirement is not tied to an age. It is tied to a dollar amount (net worth). Remember this every time you spend money. That purse does not cost $500. It costs a few days of your retirement. Still worth it?

20. If you don’t feel like responding, don’t respond. You do not owe anyone your time. You do not owe anyone an explanation. You do not owe anyone anything.

21. Buy and hold index funds. Remember when you were 22 and that financial advisor explained these “buckets” of investments you didn’t really understand so you went to your car after and cried because you felt stupid? Well, listen to him and buy more of them.

22. Before you buy something, ask yourself:

- Do I need it?

- Do I personally value it? Or am I buying it to impress people or appeal to current trends?

- Is this purchase in response to an unpleasant emotion?

- Can I just stand here, admire it for a minute, and *not* buy it instead?

23. Your loved ones’ problems are not your problems. They will feel personal and frustrating and exhausting. But they are not your problems. It will feel that way because the situation persists. People may not choose their problems initially, but they do choose to keep having them.

24. Working for an impressive and valuable company means nothing if that company does not impress you. It means nothing if they do not value you. Know your worth and know when you’re in a place that does not recognize it.

25. What you’re feeling is anxiety. I don’t know exactly when you’ll get it, but the terror and dread you feel about work and obligations? That’s anxiety. The sooner you admit it, the sooner you can handle it and seek help.

26. Dogs are one of the best forms of companionship, therapy, and emotional healing. A blessing, not a burden.

27. It will make sense why the temporary men didn’t work out. Enjoy the novelty and the first dates. You’ll get some good insight on what you do and don’t like in a partner. Just know these fleeting relationships are not going to feel disposable forever. Someone will come along and you’ll get to experience all those romantic micro-moments. Eating take-out in your PJs. Carnival rides and hot apple cider. Christmas lights in December. It will feel like the loneliness was justified—to show you how un-alone the right person can make you feel.

🎂 Check out last year’s advice → 26 Things I’d Tell My Younger Self

Some influential people and communities that have shaped my thinking in this last year:

💛 Life + Love

- Instagram: @briannawiest, @positivelypresent, @millenial.therapist, @thematthewhussey, @yrsadaleyward

- Book: The Subtle Art of Not Giving a F*ck by Mark Manson

👛 Finance

- Instagram: @personalfinanceclub, @thefinancialdiet, @paulapant, @ladiesgetpaid (+1 their local meetups, see if they have a chapter in your city)

- Reddit: r/financialindependence, r/FIRE

- Podcast: ChooseFI (+1 their Facebook community)

- Blog: Mr. Money Mustache